2020 National State of Latino Entrepreneurship Report

The Stanford Latino Entrepreneurship Initiative (SLEI) recently released its 2020 State of Latino Entrepreneurship report, which was highlighted in an event hosted by Stanford Graduate School of Business and Latino Business Action Network on January 29. The report highlights the impact of Latino-owned employer businesses (LOBs) in the U.S. economy and compares their experiences to those of White-owned employer businesses (WOBs).

Overall, the report showed LOBs are underrepresented and make less money than WOBs. Additionally, LOBs may face greater challenges in weathering the pandemic due to less access to relief loans and financing in general, which hinders growth. However, despite these challenges, LOBs are growing—in numbers and revenues—at rates higher than WOBs.

Here are some of the key highlights from the presentation and report:

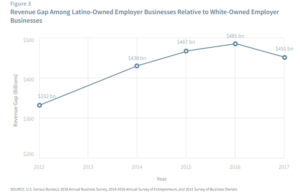

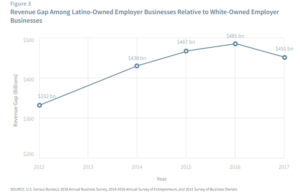

- The gap between the percentage of Latino and White-owned employer firms is much larger than their representation as a percentage of the population, and for every dollar in revenue earned at a LOB, there is $20 in revenue for a WOB.

- The large revenue gap can partially be explained by the fact that Latino-owned businesses overall tend to start small and remain small.

- The large revenue gap can partially be explained by the fact that Latino-owned businesses overall tend to start small and remain small.

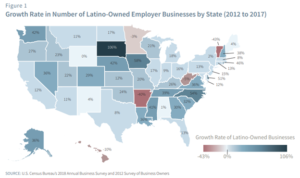

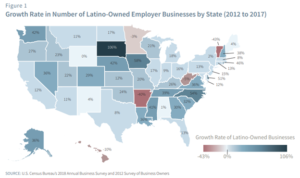

- Latinos are starting businesses at a faster rate than the national average across almost all industries and states.

- The number of Latino business owners has grown 34% over the last 10 years compared to just 1% for all others, making LOBs the fastest growing segment of the small business ecosystem.

- As shown in Figure 1, the number of LOBs grew in 45 out of 50 U.S. states (and the District of Columbia), including an 11% growth rate in Arizona.

- Growth rate of the number of LOBs was highest in the following industries: 1) Construction, 2) Finance and Insurance, 3) Transportation and Warehousing, and 4) Real Estate.

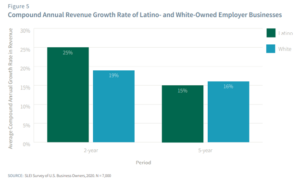

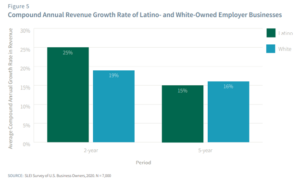

- LOBs are growing revenues at a faster rate than WOBs (although the average annual revenue of LOBs is still lower than that of WOBs).

- As shown in Figure 5, over the past two years, LOBs have grown their revenue at a compound annual growth rate of 25% compared to 19% for WOBs.

- As shown in Figure 5, over the past two years, LOBs have grown their revenue at a compound annual growth rate of 25% compared to 19% for WOBs.

- The odds of loan approval from national banks are 60% lower for Latinos compared to White business owners, when controlling for business performance. Latinos are accessing funding from high-interest, high-risk sources.

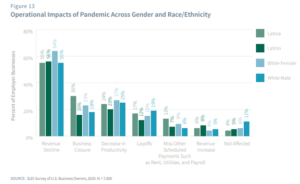

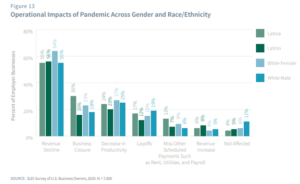

- Latinas are most negatively impacted by the pandemic, with twice as many Latina-led companies experiencing closure compared to Latino-led companies

- White business owners were twice as likely to have their Paycheck Protection Program (PPP) funding approved relative to Latinos.

- LOBs that leverage organizational networks (e.g. chambers of commerce, trade associations, economic development organizations) are more than twice as likely to experience funding success than those that did not engage in any networking activities.

To read the full report, visit Stanford’s 2020 State of Latino Entrepreneurship page or watch the 2021 State of Latino Entrepreneurship Forum video, which provides highlights from the report.

2020 National State of Latino Entrepreneurship Report

The Stanford Latino Entrepreneurship Initiative (SLEI) recently released its 2020 State of Latino Entrepreneurship report, which was highlighted in an event hosted by Stanford Graduate School of Business and Latino Business Action Network on January 29. The report highlights the impact of Latino-owned employer businesses (LOBs) in the U.S. economy and compares their experiences to those of White-owned employer businesses (WOBs).

Overall, the report showed LOBs are underrepresented and make less money than WOBs. Additionally, LOBs may face greater challenges in weathering the pandemic due to less access to relief loans and financing in general, which hinders growth. However, despite these challenges, LOBs are growing—in numbers and revenues—at rates higher than WOBs.

Here are some of the key highlights from the presentation and report:

- The gap between the percentage of Latino and White-owned employer firms is much larger than their representation as a percentage of the population, and for every dollar in revenue earned at a LOB, there is $20 in revenue for a WOB.

- The large revenue gap can partially be explained by the fact that Latino-owned businesses overall tend to start small and remain small.

- The large revenue gap can partially be explained by the fact that Latino-owned businesses overall tend to start small and remain small.

- Latinos are starting businesses at a faster rate than the national average across almost all industries and states.

- The number of Latino business owners has grown 34% over the last 10 years compared to just 1% for all others, making LOBs the fastest growing segment of the small business ecosystem.

- As shown in Figure 1, the number of LOBs grew in 45 out of 50 U.S. states (and the District of Columbia), including an 11% growth rate in Arizona.

- Growth rate of the number of LOBs was highest in the following industries: 1) Construction, 2) Finance and Insurance, 3) Transportation and Warehousing, and 4) Real Estate.

- LOBs are growing revenues at a faster rate than WOBs (although the average annual revenue of LOBs is still lower than that of WOBs).

- As shown in Figure 5, over the past two years, LOBs have grown their revenue at a compound annual growth rate of 25% compared to 19% for WOBs.

- As shown in Figure 5, over the past two years, LOBs have grown their revenue at a compound annual growth rate of 25% compared to 19% for WOBs.

- The odds of loan approval from national banks are 60% lower for Latinos compared to White business owners, when controlling for business performance. Latinos are accessing funding from high-interest, high-risk sources.

- Latinas are most negatively impacted by the pandemic, with twice as many Latina-led companies experiencing closure compared to Latino-led companies

- White business owners were twice as likely to have their Paycheck Protection Program (PPP) funding approved relative to Latinos.

- LOBs that leverage organizational networks (e.g. chambers of commerce, trade associations, economic development organizations) are more than twice as likely to experience funding success than those that did not engage in any networking activities.

To read the full report, visit Stanford’s 2020 State of Latino Entrepreneurship page or watch the 2021 State of Latino Entrepreneurship Forum video, which provides highlights from the report.